Cardano’s stake pool pledge and margin mechanics

January 26, 2022

Stake pool operators can use the mechanics of Cardano’s pool pledge and margin to optimize rewards

Anyone operating a node or stake pool on a proof of stake (PoS) protocol will want to earn the highest possible rewards. The best way to do this is by operating the node at its highest level of performance — not missing blocks, staying updated and in sync with the chain, and avoiding downtime.

But some protocols — including Cardano — have extra ways to optimize participation (and rewards). Cardano offers three ways to do this: the pool pledge, pool margin, and pool fixed cost. Which works best for you will depend on your individual goals and whether you intend to operate a private stake pool or accept “delegations” (contributions) from outside token holders.

To understand what will work best, you have first to understand how Cardano’s rewards parameters work. Then you can explore whether to concentrate on the pledge, margin or costs to earn maximum rewards.

The parameters

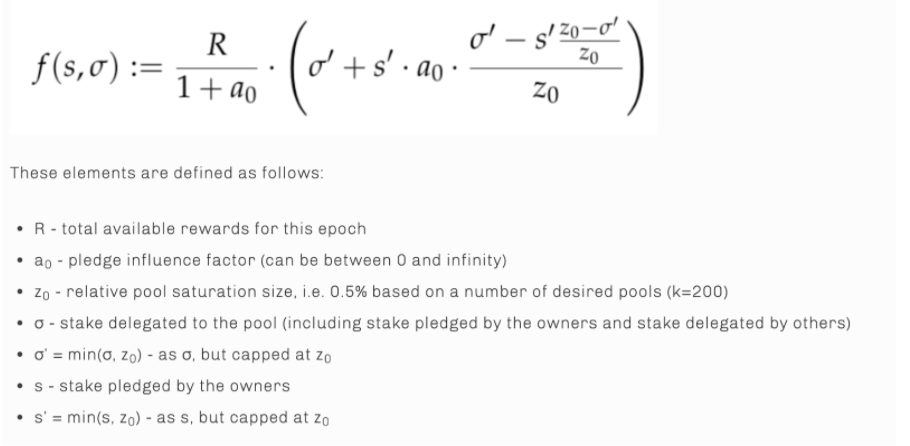

Cardano has two protocol‐set parameters to prevent centralization. These control how much ADA — Cardano’s native cryptocurrency — and how many pools each stakepool can control. They are the k parameter and the a0 parameter.

The Saturation Parameter (k) controls the number of stake pools in the network, and increases decentralization by creating incentives to create more stake pools.

The parameter determines how much stake in a single pool will earn rewards. The higher the k parameter, the lower the maximum stake cap per pool. Any stake above the maximum does not qualify for additional rewards.

For example, if the k parameter sets the stake cap per pool at 100 ADA, a stake pool with 100 ADA staked and one with 200 earn the same rewards. A stake pool is most profitable when it reaches but doesn’t surpass the stake cap.

As of December 2020, the k parameter on Cardano is 500, setting the saturation point (stake cap) for a stake pool at 64 million ADA.

The second parameter is the Pledge Influence Parameter (a0). This adjusts rewards to reflect the pool’s percentage of pledged tokens. It aims to create incentives for pledging more of your stake to a single pool, rather than splitting it. This promotes decentralization by encouraging large operators to control fewer pools with a high pledge, rather than many pools with a low one.

As there is no slashing in Cardano, pledging is an important way to prevent Sybil Attacks on the network. Adding X amount of pledge to a pool increases its rewards by up to a0*X.

Cardano's rewards equation Source

Cardano’s rewards mechanics

First, let’s define some terms:

Pledge amount: an amount of self‐bonded assets intended to remain staked to the pool for as long as it operates

Fixed cost: a set fee deducted to cover the pool’s operating costs

Margin: the percentage of rewards taken by the stake pool operator after the fixed cost but before rewards are distributed pro‐rata

The Reserve: ADA not yet issued into circulation or the treasury

Expansion rate: the amount of ADA used for rewards, currently ∼0.3% of the Reserve per epoch

Staking rate: the ratio of ADA actively staked to the total amount of ADA in circulation.

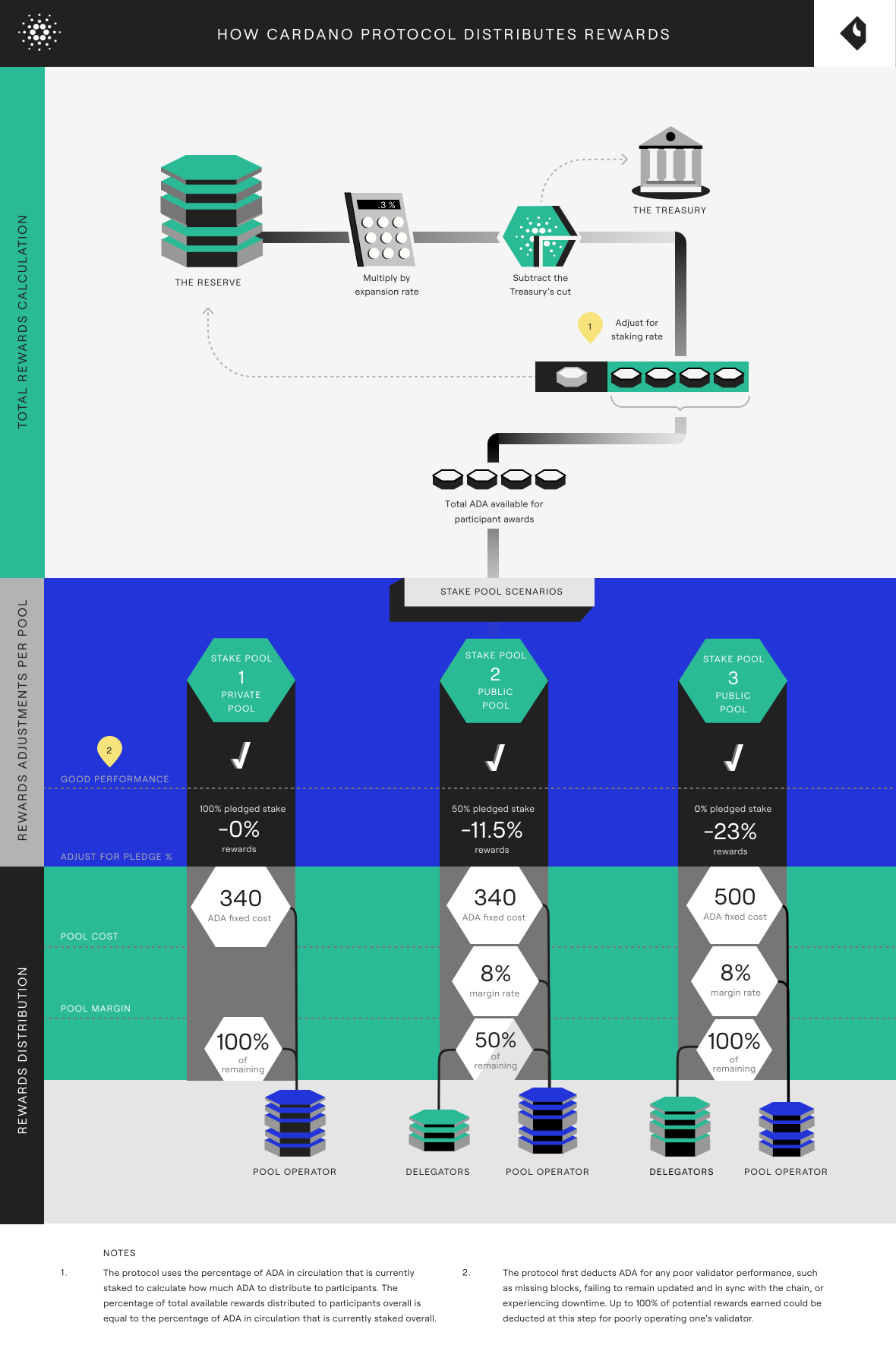

Each epoch, the amount of inflationary rewards to be distributed to all the stake pools is determined in this way:

The total possible rewards are calculated using the expansion rate.

The treasury’s cut (currently 20%) is subtracted.

The staking rate is used to calculate how much ADA should be distributed to participants.

The protocol initially assumes that all the remainder will be distributed equally among token holders, but when it finds that less than 100% of ADA tokens are staked, the percentage of rewards tokens that would have gone to non‐staked tokens are sent back to the Reserve.

Once the total pool of rewards available to participants for the epoch is determined, the protocol distributes them to participating stake pools.

First it divides the total pool of rewards available by participating stake pools. For each pool it then:

Subtracts any penalties for poor stake pool behavior.

Adjusts rewards to reflect the pool’s percentage of pledged tokens using the a0 parameter.

Pays the pool operator the fixed cost.

Pays the pool operator the margin.

Distributes the remaining pool rewards proportionally, based on stake (pro‐rata to delegators and the stake pool operator).

Cardano's rewards process

The goals

Cardano stake pool operators can be either private, using only their own self-bonded stake, or public, by accepting delegation.

A private stake pool retains 100% of the pool’s profits but must also provide 100% of the pool’s staking power. Alternatively, accepting delegation increases the number of entities that can contribute to a pool’s stake, but also increases the number of entities that receive the rewards as delegators get a pro‐rata share of the pool’s profits.

By default, a pool with a margin set below 100% is considered a public pool; ADA holders may choose to delegate their stake to it.

A stake pool is by default private if its margin rate is set to 100%—meaning that the stake pool operator retains 100% of the pool’s profit margin. As such, delegators should not delegate to it as they do not earn any rewards for their delegation, and most stake pool explorers will not give the pool visibility as a staking option for that reason.

When setting up their stake pool, an operator must decide whether it will be public or private. Once that is determined they can go about optimizing their participation and expected rewards.

Pool pledge mechanics

As a stake pool operator you must first consider your pool pledge amount.

Pledging is optional, but this self‐bonded amount shows the protocol that operators have “skin in the game”. Locking up some of their own stake helps secure the protocol and works to prevent Sybil Attacks on the Cardano network. The pool’s reward rate is increased as an incentive for operators to pledge ADA. The more you pledge, the higher the pool’s reward rate.

A pool that reaches the stake cap solely through ADA pledged by the operator qualifies for maximum rewards. As the pledge percentage decreases, so do total rewards. A stake pool that reaches the cap completely from delegation will earn only 77% of the rewards available to one composed entirely of pledged ADA.

Optimized pledging for private and public pools

Private stake pool operators optimize rewards by pledging the whole stake cap for their pool. If you have enough ADA to meet the saturation point alone, your rewards will be 100% of the potential earned when adjusted for the a0 parameter.

Public stake pool operators must balance their pledge amount with the expected delegation amount. Delegators will consider an operator’s pledged amount when choosing a pool. A high pledge signals a long‐term commitment to operating the stake pool, increasing delegator rewards. However, a larger pledge amount reduces the room for productive contributions from delegators before the stake cap is reached.

Some pool operators may adjust their pledge amount over time. Others may prioritize other rewards factors, community engagement, or promoting their pool’s robust performance to attract outside delegations.

Pool fee mechanics

As a private stake pool operator, you keep 100% of the rewards margin, so you don’t have to spend time determining an appropriate pool cost or margin. You should set the pool cost at the minimum allowed by the protocol, and the margin to 100%.

If you choose a public stake pool, however, you earn fixed and variable fees from delegators for conducting validation services. At the end of each epoch, you retain a set amount of ADA (pool cost) to cover operating costs, regardless of market fluctuations. You also receive a percentage of the remaining pool rewards (pool margin). You determine the pool margin rate yourself, allowing you to scale up rewards from the pool’s success.

Public stake pool operators must determine the best fixed fee and margin rate to optimize their own rewards and those of delegates. Fees can be updated to account for market changes — such as fluctuations in the cost of ADA, changes in operating costs, or increased/decreased rates of delegation to the pool.

The minimum pool cost is 340 ADA per epoch. Operators are encouraged to set realistic fixed costs that accurately reflect the expense and time of running the stake pool. You will also be encouraged to be transparent with potential delegators if your cost is in the higher range, noting any special features, such as providing multi‐regional failover and enterprise‐grade infrastructure that increase expenses.

Pool operators should set a margin that is competitive but also takes their performance advantages into account. Promoting special features of your stake pool — such as 99% uptime, enterprise‐grade security, professional node maintenance, or high participation rates — are all good reasons for a higher than average profit margin. These features will contribute to increased security and higher validation performance, bringing higher rewards for your delegators.

How do I get involved?

Use this calculator from Cardano to work out the potential rewards you might earn from different stake pool scenarios, including the amount of pledged and delegated tokens, varying margin rates and fixed pool costs.

Learn more about Cardano, its economics, and how the protocol functions, in our guide.

The best way to maximize rewards is to operate a stake pool successfully. All the ways to maximize rewards discussed here are based on the assumption that the pool is performing at the highest level possible.

Running a Cardano node with Coinbase Cloud

Enterprise‐grade infrastructure security As one of the most trusted names in the blockchain infrastructure industry, we have best‐in‐class security augmented by information, application, and incident management policies.

Easy‐to‐use platform We designed an intuitive user experience that is surprisingly simple given the complexity of the underlying technology. Our automatic node management workflow frees customers from constantly checking or managing their active participation. We also keep our customers in full control.

Infrastructure and protocol engineering experts We’re node, participatory infrastructure, and protocol experts. We test all software, infrastructure, and protocol upgrades on our own infrastructure first, ensuring any breaking issues are caught well before propagating changes to our customers’ infrastructure.

Protocol knowledge Our dedicated protocol specialists keep customers up to date about changes to the stake pool ecosystem. They provide advice, insights, and guidance, arming our customers with critical information to better manage their participation.

Premium provider We are the world’s premier multi‐cloud, multi‐region infrastructure provider, specializing in permissionless participatory networks.

Custodian agnostic As a non‐custodial infrastructure provider, we can work with you to participate in Cardano regardless of your custody solution.