The Bitcoin Halving: Everything you need to know

Around April 19-20, 2024, the block reward will be reduced from 6.25 Bitcoin per block to 3.125 Bitcoin per block.

The Bitcoin Halving explained

What is the Bitcoin halving?

Every four years, on the halving day, the amount of new Bitcoins created gets cut in half. This means that when Bitcoin halves, the reward given to the contributors securing the network is reduced by 50%, directly impacting the rate at which new Bitcoins are introduced into circulation. This is what we're referring to as the halving day.

At the beginning of 2020, 12.5 new Bitcoins were added to the network every 10 minutes via virtual "mining." In May, that amount was halved to 6.25. In April 2024, it will drop again to around 3.125 — and the process will continue until all 21 million coins have been mined (which estimates say should happen around the year 2140). This process, coded into the Bitcoin protocol by Satoshi Nakamoto, the creator of Bitcoin, is a way to limit the total supply of Bitcoin, increasing its scarcity.

What Happens When Bitcoin Halves?

When Bitcoin undergoes a halving, the number of new Bitcoins that are made gets cut in half. Said differently, there's a 50% reduction in the reward miners receive for validating transactions and adding them to the blockchain.

This event is coded into the Bitcoin protocol and occurs approximately every four years or after 210,000 blocks.

Why is the Bitcoin halving important?

When Bitcoin halves, the reward given to the contributors securing the network is reduced by 50%, directly impacting the rate at which new Bitcoins are introduced into circulation. And because there are only 21 million bitcoins and the halving makes fewer of them, the halving contributes to making bitcoins more scarce.

This inherent scarcity, combined with the historic increase in demand after the previous halving events, fosters a sense of digital rarity that could lead to potential upward pressure on prices.

Create a Coinbase account to trade Bitcoin. It’s quick, easy, and secure.

Why is the Bitcoin halving important?

When Bitcoin halves, the reward given to the contributors securing the network is reduced by 50%, directly impacting the rate at which new Bitcoins are introduced into circulation. And because there are only 21 million Bitcoins and the halving makes fewer of them, the halving contributes to Bitcoin's deflationary nature, making people think of Bitcoin as something special and rare.

This inherent scarcity has historically contributed to increased demand and, consequently, potential upward pressure on the price, highlighting Bitcoin's departure from traditional fiat currencies (government-backed money), which are subject to inflationary pressures.

But this is not the only reason why Bitcoin halving is important.

Bitcoin halving drives miners to optimize energy consumption and increase hash power, contributing to the sustainability and long-term viability of the Bitcoin ecosystem.

The deliberate reduction in the issuance of new coins makes Bitcoin increasingly scarce over time, fostering a sense of digital rarity, a key factor that underpins Bitcoin's appeal and potential as a store of value.

The anticipation leading up to a halving often sparks discussions and educational initiatives about the fundamental principles of Bitcoin, blockchain technology, and cryptocurrency economics.

You've got Bitcoin halving questions. We've got answers.

Is there anything I need to do to prepare for the halving?

The short answer is No. But while no direct action is required for individual users, staying informed about the event's timing and potential market impacts is always good, whether you are a newcomer or an expert. If you're a newcomer, you can benefit from educating yourself on the basics of the halving process and understanding its role in the broader context of the crypto market. If you're a long-term investor, you may consider adjusting your strategies in light of historical trends associated with halving events — monitoring market sentiment and being cautious of short-term volatility.

What is the historical impact of Bitcoin halving on BTC's price?

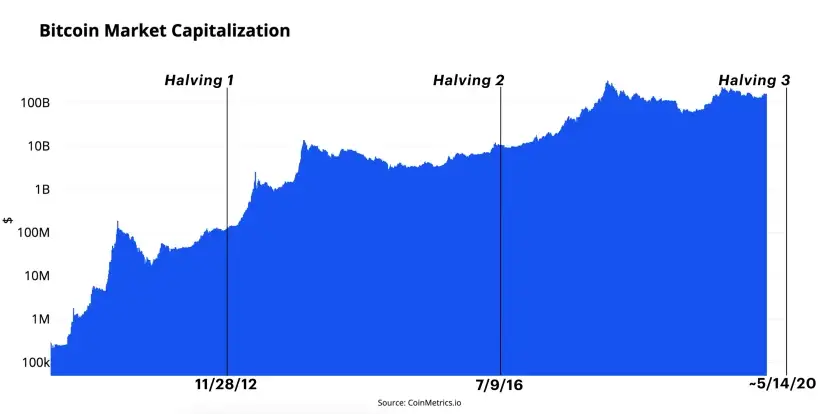

The historical correlation between halving events and the bitcoin price exists, with the price of bitcoin substantially increasing approximately six months after the halving days from 2012, 2017, and 2020. But while this correlation exists, it's important to remember that correlation does not imply causation and that various factors, including market sentiment, adoption trends, and macroeconomic conditions, contribute to price movements.

Consider this: if it were universally anticipated that bitcoin's value would surge immediately following the 2024 halving, investors would likely move to acquire bitcoin before the event, driving up its price in the present rather than in the future. Therefore, even though a decreased rate of new bitcoin entering the market theoretically suggests heightened scarcity and could, in principle, boost demand and potentially elevate the price, it's not a standalone factor that can reliably predict or trigger a significant surge in bitcoin's value.

What will the Bitcoin Halving mean for existing Coinbase users?

While Coinbase users won't experience direct changes on the platform due to the halving, they may notice increased market activity and potential price fluctuations. Coinbase, as a centralized cryptocurrency exchange, will play a role in facilitating trading during this event.

Does Bitcoin halving impact transaction fees on the network?

Bitcoin halving indirectly influences transaction fees on the network. As the block rewards for miners decrease, there may be increased competition among users to have their transactions included in the limited space of each block. This heightened competition can lead to higher transaction fees as users offer higher fees to expedite their transactions' processing. This is why it's essential for users, especially newcomers, to be mindful of potential fluctuations in transaction fees during and after a halving event, adjusting their strategies accordingly.

Are there risks associated with Bitcoin halving?

While Bitcoin halving is generally viewed as a positive event, there are inherent risks, particularly in the short term. The anticipation leading up to the halving can create speculative market behavior, potentially resulting in increased volatility. It's also good to note that there may be temporary price corrections if the market's expectations are not met.

When did the previous Bitcoin halvings happen?

There have been three halvings as of January 2024:

- Nov. 28, 2012, reducing the number of new bitcoin created per block from 50 to 25.

- July 9, 2016, reducing the number of new bitcoin created per block from 25 to 12.5.

- May 11, 2020, reducing the number of new bitcoin created per block from 12.5 to 6.25.

Why are the halvings occurring more frequently than the standard four-year cycle?

While Bitcoin halvings are conventionally expected every four years, the actual time between them can vary due to the protocol's self-adjusting mechanism. The 10-minute block time target ensures that approximately every 10 minutes, a new block is added to the blockchain.

However, as mining power in the network fluctuates, this target is met sooner or later. If miners collectively surpass the target, the difficulty adjusts upward, making the next halving occur later than the expected four-year timeframe.

What happens when there are no more Bitcoins left to be mined?

The scenario of no more bitcoins being left is actually a fundamental aspect of Bitcoin's design. As mining rewards decrease with each halving, the last bitcoin is projected to be mined around the year 2140. At this point, miners will rely solely on transaction fees for validating blocks.

Should BTC holders worry about the Bitcoin halving?

Bitcoin holders need not necessarily worry about a halving event, as it is a programmed and anticipated occurrence. However, it's crucial for holders to be aware of potential short-term market volatility around the time of a halving. Historically, Bitcoin halvings have been associated with increased market attention and speculation, leading to price fluctuations. However, holders are advised to approach a halving with a measured and informed perspective, considering their individual risk tolerance and investment goals in the dynamic cryptocurrency market.

How to trade the Bitcoin halving on Coinbase?

You can buy bitcoin directly via Coinbase.

- Create a Coinbase account. Download the Coinbase app and start the sign up process. You will need a valid ID and may be asked for proof of address in order to transact, so be sure to have those ready. Verifying your ID may take longer than a few minutes, depending on where you live.

- Add a payment method. Tap on the payment method box and connect a payment method. You can use a bank account, debit card or initiate a wire.

- Start a trade. Press then select "Buy" from the list of options.

- Select bitcoin. Tap on the payment method box and connect a payment method. You can connect a bank account, debit card or initiate a wire.

Create a Coinbase account to trade Bitcoin. It’s quick, easy, and secure.

Bitcoin market latest

Bitcoin is climbing this week

The current price of Bitcoin is $63,272.62 per BTC. With a circulating supply of 19,691,100 BTC, it means that Bitcoin has a total market cap of $1,244,875,909,810.21. The amount of Bitcoin traded has fallen by $4,031,044,663.34 in the last 24 hours, which is a 20.76% decrease. Additionally, in the last day, $19,419,025,704.00 worth of BTC has been traded.

Bitcoin statistics

When is the next Bitcoin halving?

The exact time of the halving is determined by the network hashrate. The current estimated date of the halving is April 17, 2024. To better understand the implication of this next halving, let's take a look back at the previous ones:

Create a Coinbase account to trade Bitcoin. It’s quick, easy, and secure.

Learn about Bitcoin

What is a Bitcoin halving?

A beginner's guide to cryptocurrency. Learn about BTC, ETH, and USDC.

What is Bitcoin?

The world’s first widely-adopted cryptocurrency. With Bitcoin, people can securely and directly send each other digital money on the internet.

What is mining?

From diamond hands to the flippening, we break down 11 of the most popular pieces of crypto lingo

What is a bull or bear market?

In an ideal world, it’s simple: buy low, sell high. In reality, this is easier said than done

What is volatility?

As the cryptoeconomy grows and evolves, there are more ways than ever to earn rewards for holding crypto, learning about crypto, or interacting with

What is dollar cost averaging?

Whether you're just starting your crypto journey or you've been trading Bitcoin for years, there’s a good chance you’ve tried to dig into the world beyond

Bitcoin in Coinbase Blog

Announcing our first Bitcoin Core developer grants

At Coinbase, our Security team not only monitors the safety of our platform and customers’ funds, but also security threats and abuse trends impacting the larger cryptoeconomy. In December 2020, person

Digital Gold, Scarcity, and Bitcoin Halvings

What gives money value? Today, the value of a dollar is not directly tied to the value of any other asset. Not so long ago, money was directly pegged to gold. Until 1971, one ounce of gold was redeemab

Around the Block #2: things you need to know about the Bitcoin halving and Ethereum’s competitors nearing launch

Coinbase Around the Block sheds light on key issues in the crypto space. In this edition, we reveal key takeaways from the upcoming Bitcoin halving as well as Ethereum’s newest competition

What is the Bitcoin Halving?

Bitcoin is often called “ digital gold ” because just like gold, Bitcoin is a valuable, scarce resource that’s resistant to inflation. But unlike gold, Bitcoin is digital — it can be sent globally alm

Is the Bitcoin Lightning Network for real?

In the 13 years of its existence, Bitcoin has risen from obscurity to $1 trillion highs, settling over $60 trillion in total transfer volume along the way. Despite these feats, Bitcoin’s decentralized

FACT CHECK: Is Bitcoin mining environmentally unfriendly?

First, a basic fact: Bitcoin mining is an energy-intensive process. There’s no debate about that. As prices climb, new miners are incentivized to participate, which drives up energy usage (at least unt

Create a Coinbase account to trade Bitcoin. It’s quick, easy, and secure.

Bitcoin price calculator

Last update: 11:02 PM, April 27, 2024

Refresh

Bitcoin to popular currencies

Conversion Table

BTC/USD (United States Dollar)

$63,274.78

BTC/CAD (Canadian Dollar)

CA$87,393.60

BTC/GBP (British Pound)

£50,260.43

BTC/JPY (Japanese Yen)

¥10,023,600.50

BTC/INR (Indian Rupee)

₹5,277,353.93

BTC/BRL (Real)

R$323,734.87

BTC/EUR (Euro)

€59,228.60

BTC/NGN (Nigerian Naira)

NGN 83,483,361.90

BTC/KRW (South Korean Won)

₩87,197,017.97

BTC/SGD (Singapore Dollar)

S$86,226.65

Discover more assets

Popular crypto assets

Here is a selection of Bitcoin trading pairs that people watch and convert.

Buy other crypto

A selection of guides on how to buy other popular crypto currencies based on your interest in Bitcoin.

Discover more cryptocurrencies

Here is a selection of popular crypto assets that people also watch and convert.

Discover ENS Profiles

Navigate the world of Ethereum Name Service (ENS) profiles on profile.coinbase.com. Check out some of the most popular ENS profiles below.

Create a Coinbase account to trade Bitcoin. It’s quick, easy, and secure.